The Importance of Real Estate Investment Analysis Classes

In the ever-evolving realm of real estate, investment analysis serves as a cornerstone for informed decision-making and enhanced profitability. Real estate investment analysis classes are designed to equip investors with the necessary tools and methodologies to assess potential investment opportunities rigorously. Such classes delve into the intricacies of market trends, financial forecasting, and risk management. They emphasize the critical examination of property values, revenue streams, and associated costs. By understanding these critical components, investors can develop strategies that maximize returns while mitigating risks. Consequently, participating in these classes offers a structured approach to understanding the complexities of real estate investments, ensuring that investors are well-prepared to navigate the market’s fluctuations.

Read Now : Industry-specific Skill Development Courses

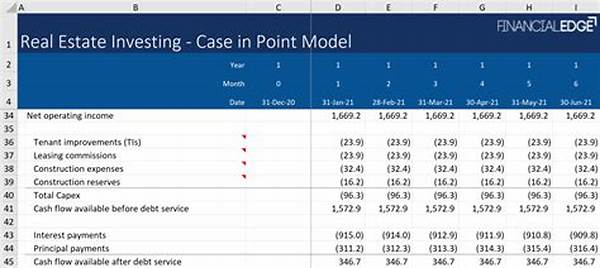

Real estate investment analysis classes also focus on the analytical tools and techniques required to dissect market data effectively. These classes cover a range of topics from cash flow analysis to the utilization of financial ratios and the interpretation of market indicators. Furthermore, students learn to apply principles such as cap rate and net present value to evaluate potential investments robustly. Such knowledge empowers individuals with the ability to make data-driven decisions, thereby enhancing their ability to identify lucrative opportunities. Understanding and applying these analytical skills can lead to more strategic investments and improved financial outcomes.

Moreover, real estate investment analysis classes provide an interactive learning environment where participants can engage with industry experts and peers. This interaction facilitates the exchange of insights and experiences, fostering a collaborative approach to understanding property markets. Networking opportunities within these classes often extend beyond formal education settings, providing access to a broader community of professionals and potential mentors. As such, these classes not only equip learners with vital analytical skills but also enable them to build fruitful connections within the industry. Consequently, this comprehensive learning experience is indispensable for both novice and seasoned investors aiming to refine their expertise.

Key Components of Real Estate Investment Analysis Classes

Real estate investment analysis classes incorporate various elements that are crucial for a well-rounded understanding of the field. Firstly, these classes often begin with an overview of basic financial principles applicable to real estate. Secondly, they cover case studies that provide practical insights into real-world applications. Thirdly, technology and software tools play an essential role, offering students hands-on experience with modern data analysis platforms. Fourthly, classes often invite guest speakers from the industry to share their expertise. Lastly, assessments and projects are used to solidify learning and ensure practical application of knowledge gained.

These classes are designed to cater to a diverse audience, ranging from beginners with no prior experience in real estate to seasoned professionals looking to deepen their analytical skills. The curriculum is typically structured to progress from basic concepts to more advanced topics. By ensuring that participants have a firm grasp of foundational ideas before moving on to complex subjects, real estate investment analysis classes maintain a logical flow that aids in comprehension and retention.

Moreover, real estate investment analysis classes emphasize the importance of ethical considerations in investment decision-making. Integrity and ethical practices are integral to maintaining investor trust and sustainable success. Classes often integrate discussions around ethical dilemmas and case studies to prepare participants for real-world challenges. By prioritizing ethical principles, these classes help cultivate a conscientious approach to real estate investing, aligning profitability with social responsibility.

Benefits of Attending Real Estate Investment Analysis Classes

Attending real estate investment analysis classes offers a multitude of benefits that extend well beyond mere knowledge acquisition. The structured environment enables learners to approach real estate investment with confidence and analytical rigor. By participating in such classes, individuals gain access to seasoned professionals and industry leaders who can provide valuable insights and mentorship.

Another significant advantage of real estate investment analysis classes is the development of critical thinking skills. As students navigate through complex case studies and market analyses, they learn to apply strategic thinking to identify and evaluate investment opportunities. This skill set is invaluable in navigating real estate markets characterized by volatility and uncertainty. Furthermore, classes often provide opportunities for networking with peers and industry veterans, establishing connections that can be invaluable for future ventures.

In addition to fostering technical and analytical proficiency, real estate investment analysis classes instill a strong foundation in risk assessment. Understanding potential risks associated with different investment scenarios allows participants to develop strategies designed to mitigate exposure. By exploring various risk management techniques, students become equipped to shield their investments from unforeseen market downturns and other adverse conditions. This holistic approach to real estate investment serves as a robust framework for long-term success.

Exploring Curriculum Highlights of Real Estate Investment Analysis Classes

Real estate investment analysis classes often feature a comprehensive curriculum designed to cover the breadth and depth of the field. Key highlights of these classes include modules on financial modeling, which equip learners with the ability to create dynamic models that simulate cash flow projections and value assessments. Furthermore, appraisal techniques are explored to provide participants with an understanding of property valuation.

A significant portion of the curriculum is dedicated to understanding real estate market cycles and economic indicators. By recognizing macroeconomic factors and their impact on property markets, participants can make well-informed investment decisions. Additionally, these classes frequently offer specialized modules on different real estate sectors, such as residential, commercial, and industrial properties, allowing for tailored learning experiences.

Read Now : Memory Enhancement Tips For Students

Practical applications of theoretical knowledge are emphasized through case studies and project-based learning. Participants are encouraged to employ analytical tools to dissect case studies that mirror real-world scenarios. This practical approach enhances retention and provides learners with hands-on experience, allowing them to understand the implications of their analyses in the context of actual investment decisions. Such multifaceted exposure is indispensable for developing a comprehensive understanding of real estate investment analysis.

Networking and Community Building in Real Estate Investment Analysis Classes

Real estate investment analysis classes serve as a vibrant hub for networking and community building. These classes provide an environment where individuals with shared interests and aspirations can connect and collaborate. Participants, ranging from neophytes to seasoned investors, exchange ideas and experiences, fostering a dynamic community that supports professional growth.

The opportunity to interact with industry experts through guest lectures and workshops enriches the learning experience. These industry professionals offer insights and advice that cannot be gleaned from textbooks alone, providing participants with real-world perspectives on investment analysis. Additionally, relationships formed in these classes often extend beyond the classroom, evolving into long-lasting professional connections.

By fostering a culture of collaboration and knowledge-sharing, real estate investment analysis classes become invaluable resources for cultivating a supportive professional network. The shared learning journey creates a foundation of mutual trust and respect, laying the groundwork for potential partnerships and collaborative ventures. As a result, participants are better positioned to leverage these networks as they navigate their real estate investment careers.

Summary of Real Estate Investment Analysis Classes

Real estate investment analysis classes provide a structured educational experience that equips participants with vital analytical skills, enhancing their ability to make informed investment decisions. These classes offer a curriculum that encompasses foundational financial principles, advanced analytical techniques, and hands-on experience with relevant technology. By fostering critical thinking and strategic decision-making, participants are well-prepared to navigate the complexities of real estate investment.

The experiential learning approach of real estate investment analysis classes ensures that participants gain both theoretical knowledge and practical expertise. Interactive elements, such as case studies and project-based learning, allow learners to apply analytical tools effectively in real-world scenarios. Furthermore, networking opportunities and community engagement foster a collaborative environment that enhances professional development.

In summary, the comprehensive nature of real estate investment analysis classes makes them an invaluable asset for anyone looking to excel in the field. Whether one is a beginner seeking foundational knowledge or a seasoned investor aiming to refine their skills, these classes offer a pathway to success in the dynamic world of real estate investment.