In the realm of financial management, budgeting templates serve as instrumental tools, facilitating the prudent allocation of resources and effective planning for both individuals and businesses. These templates provide a structured format, underscoring the necessity for clarity, organization, and comprehensiveness in financial planning. The key elements in budgeting templates are crucial for translating financial intentions into actionable plans, ensuring that expenditures are meticulously tracked against anticipated incomes, and potential adjustments are made accordingly.

Read Now : Trade-specific Certification Courses Online

Understanding the Key Elements in Budgeting Templates

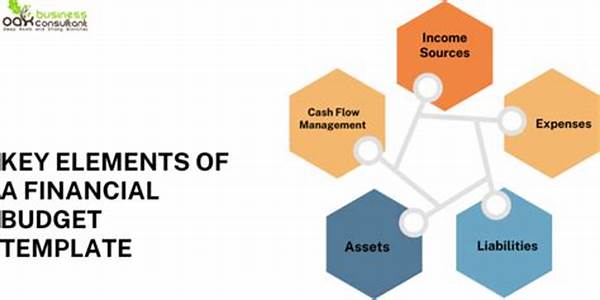

At the core of any robust financial strategy lies the budget, a critical instrument for achieving financial objectives. The key elements in budgeting templates are conceived to guide the user through a systematic process of financial planning. Primarily, these elements include income tracking, expense categorization, and savings goals, each playing a pivotal role. Income tracking provides a clear picture of all potential revenue streams, encompassing salaries, dividends, or any other monetary inflows. Expense categorization follows closely, delineating outflows into various mandatory and discretionary fields, which allows for better understanding and management of financial commitments.

Furthermore, a well-crafted budgeting template incorporates fields for savings and investments, ensuring that a portion of the income is dedicated to future financial security. Embedded within these templates are analytical tools that prompt users to review and adjust their budgets as per changing financial conditions. This iterative process heightens financial awareness and fosters adaptability in managing personal or corporate finances. Ultimately, the key elements in budgeting templates serve as bedrocks upon which sustainable financial strategies are built, promoting fiscal discipline and enlightened decision-making.

The Components of Key Elements in Budgeting Templates

A thorough comprehension of the key elements in budgeting templates requires an examination of several integral components. Firstly, income streams must be meticulously documented, capturing every source of revenue to forecast financial boundaries effectively. Secondly, the categorization of expenses is vital, enabling the distinction between essential and non-essential spending and aiding in the prioritization of financial commitments. Thirdly, savings and investment goals are prominent elements, reflecting a proactive stance toward financial growth and security.

Moreover, budgeting templates often incorporate a section dedicated to debt management, providing a clear outline of existing financial obligations. Lastly, these templates encompass performance review segments, facilitating reflection on financial practices and the scope for refinement. Each of these key elements in budgeting templates is instrumental in the formation of a holistic financial overview, supporting well-informed fiscal policies and strategies.

Analyzing the Influence of Key Elements in Budgeting Templates

Budgeting templates not only serve as frameworks for financial planning but also significantly influence user financial habits. The key elements in budgeting templates reveal tendencies in spending, help identify areas of financial leakage, and foster better-informed fiscal decisions. For instance, by consistently documenting income and expenditures, users can easily discern spending patterns and make informed choices regarding adjustment and optimization.

In professional settings, these templates guide corporate fiscal strategies and propose paths to improve profitability. The ability to juxtapose actual financial performance against planned benchmarks provides invaluable insights into operational efficiency and potential areas of improvement. Ultimately, the key elements in budgeting templates are indispensable in an individual’s or entity’s journey toward financial literacy and stability.

Exploring the Essence of Key Elements in Budgeting Templates

1. Income Documentation: A foundational aspect, capturing all forms of income, thereby enabling accurate financial projections.

2. Expense Classification: Distinguishes between necessary and discretionary spending, ensuring efficient resource allocation.

3. Savings Allocation: Prioritizes future financial security by earmarking funds specifically for savings or investments.

4. Debt Management: Outlines financial obligations, providing a framework for strategic debt reduction.

5. Performance Metrics: Facilitates the comparison of financial outcomes against objectives, highlighting success or areas for improvement.

6. Periodic Review: Encourages frequent evaluation and adjustment of the budget according to prevailing circumstances.

7. Flexibility Provision: Ensures adaptability in one’s financial planning, accommodating unexpected financial changes.

8. Goal Setting: Integral for both short-term and long-term financial aspirations, offering direction and motivation.

9. Cash Flow Monitoring: Ensures adequate liquidity management, preventing financial crises or shortfalls.

Read Now : Real-time Mentorship For Startups

10. Contingency Planning: Allocates resources to unforeseen expenses, safeguarding against financial instability.

11. Visualization Tools: Provides graphical representations of financial data to aid in comprehension and decision-making.

12. Compliance Records: Ensures adherence to financial regulations, fostering legal and ethical fiscal practices.

The Strategic Importance of Key Elements in Budgeting Templates

The strategic implementation of key elements in budgeting templates is a fundamental pursuit for achieving financial prowess. By incorporating a structured approach to financial planning, these elements provide the framework necessary for fiscal discipline. Realizing the importance of each element—income documentation, expense classification, and savings allocation—ushers a transformative approach to financial awareness and decision-making.

Empowering individuals and businesses alike, budgeting templates foster a proactive stance toward financial management. They aid in maintaining financial stability through prudent savings and informed expenditure decisions. Furthermore, by emphasizing debt management and cash flow monitoring, these templates provide a comprehensive overview of one’s financial health. Such comprehensive tools ensure that financial liabilities and assets are meticulously managed and optimized for future growth.

Embedding review mechanisms and performance metrics within these templates also supports the continuous enhancement of financial strategies. Users can refine their financial approaches, evaluating their alignment with current objectives and circumstances. By prioritizing goal setting and visualization, the key elements in budgeting templates transform rudimentary financial figures into motivational targets and accessible insights. This fosters a deeper understanding and engagement with one’s financial aspirations, ultimately equipping users to navigate the complexities of contemporary financial landscapes adeptly.

Details and Impact of Key Elements in Budgeting Templates

The careful articulation of key elements in budgeting templates involves understanding their impact on financial behavior and long-term planning. By capturing a comprehensive picture of income and expenses, these templates reveal insight into personal and corporate spending habits. They prompt users to reflect on their financial priorities, encouraging a shift toward savings and investments.

By integrating debt management, budgeting templates also serve as pragmatic guides in handling long-term financial obligations. They not only chart current financial commitments but also propose strategies for managing or eliminating debt. Furthermore, these templates increase transparency in financial dealings, fostering a culture of accountability and sustainability.

The inclusion of performance metrics and tools for visualization aids in effective communication of financial information. They render complex financial data into understandable formats, enabling more informed decision-making processes. Through careful scrutiny of these elements, users accumulate practical knowledge necessary to navigate financial landscapes successfully. By honing critical aspects of financial management, the key elements in budgeting templates become indispensable resources for meeting evolving financial goals through enhanced understanding and strategic analysis.

Conclusion on the Key Elements in Budgeting Templates

In conclusion, the key elements in budgeting templates constitute essential components in the formulation of effective financial strategies. These elements ensure a systematic approach to tracking income and expenses, enabling users to comprehend and optimize their financial practices. The careful employment of these templates empowers individuals and businesses to make informed decisions that align with their financial objectives.

The strategic emphasis on savings, debt management, and performance assessment within budgeting templates fosters fiscal prudence and continuity in financial planning. By integrating periodic reviews and fostering adaptability, these templates accommodate the dynamic nature of financial landscapes, ensuring sustained financial viability. Furthermore, their comprehensive nature facilitates transparency and accountability, indispensable in achieving compliance with financial standards and regulations.

Ultimately, the key elements in budgeting templates serve as pillars underpinning robust financial management systems. Their structured framework and analytical capabilities enhance the capacity for achieving financial literacy, stability, and growth. As such, they remain invaluable tools, driving the trajectory toward informed financial decision-making and long-term success.