In today’s rapidly evolving economic landscape, the significance of enhancing startup funding opportunities cannot be overstated. With burgeoning technological advancements and the increasing interest in entrepreneurial ventures, a robust funding ecosystem is essential for nurturing innovation and sustaining growth. Startups are not only vital engines for economic development but also instrumental in addressing contemporary societal challenges. Therefore, establishing a conducive environment for these ventures by enhancing funding opportunities is a matter of utmost importance for stakeholders, including governments, private investors, and financial institutions. This article delves into various strategies and considerations to foster an ecosystem that supports startups financially.

Read Now : Building Strong Foundations In Mathematics

Strategic Approaches to Enhancing Funding

Enhancing startup funding opportunities involves a multifaceted approach that relies on cooperation between different sectors and entities. A primary strategy is increasing access to capital through diverse funding channels such as venture capital, angel investors, and crowdfunding platforms. By widening these financial avenues, startups can secure the necessary resources to innovate and scale effectively. Additionally, fostering a culture of mentorship and networking among entrepreneurs and investors can significantly enhance the potential for successful funding outcomes. Governmental bodies can further support these efforts by enacting policies that incentivize investment in startups, such as tax breaks or grants. By leveraging a combination of financial, intellectual, and policy resources, the collective ecosystem can create a supportive environment for startups, ultimately enhancing startup funding opportunities.

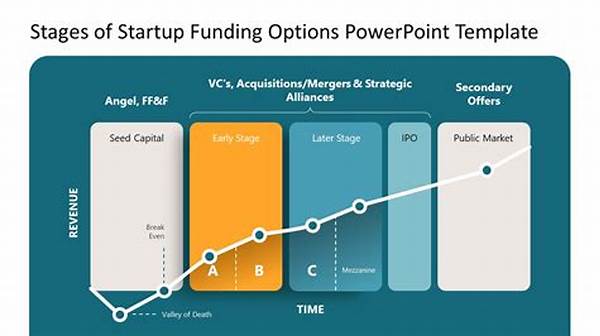

Another critical aspect of enhancing startup funding opportunities is ensuring the availability of tailored financial products that meet the unique needs of startups at different stages of development. Early-stage startups, for example, often require seed funding to transform innovative ideas into viable prototypes, while more mature startups might seek larger investments to scale operations. Financial institutions and investors can play a pivotal role by designing flexible funding instruments that address these distinct requirements. Moreover, facilitating knowledge transfer between different regions and sectors can also spur global collaboration, thus opening up more opportunities for startups to gain cross-border investments and tapping into international markets.

Financial Instruments Supporting Startups

1. Venture Capital: Enhancing startup funding opportunities through venture capital investment is pivotal, offering startups the means to scale and innovate. Venture capital firms provide the essential financial backing and expertise that help startups navigate the complexities of market entry and development.

2. Angel Investors: Angel investors play a crucial role in enhancing startup funding opportunities by providing early-stage capital. Their involvement often extends beyond financial support, offering valuable mentorship and industry connections invaluable for budding entrepreneurs.

3. Crowdfunding Platforms: Crowdfunding has emerged as a novel means of enhancing startup funding opportunities. By leveraging platforms that connect startups directly with potential supporters, entrepreneurs can obtain necessary funds while simultaneously engaging with their audience.

4. Government Grants and Subsidies: Government initiatives are instrumental in enhancing startup funding opportunities, particularly through grants and subsidies. These programs aim to reduce financial barriers for startups, thereby fostering innovation and competition across industries.

5. Corporate Venture Capital: Corporate venture capital is another strategy for enhancing startup funding opportunities, as it allows established corporations to invest in startups strategically. This form of funding enables startups to benefit from industry expertise and infrastructure provided by their corporate investors.

The Role of Policy in Funding

Policy measures play an indispensable role in enhancing startup funding opportunities. Governments around the world are increasingly recognizing the potential of startups as drivers of economic growth and societal progress. By implementing favorable regulatory frameworks, policymakers can significantly influence the ease with which startups access funding. Tax incentives, streamlined regulatory processes, and effective intellectual property protections are some examples of policy measures that can stimulate investment in startups. Such policies create an attractive environment for both domestic and international investors, thereby enhancing startup funding opportunities.

In addition to facilitating investment, policies aimed at fostering collaboration between academia, industry, and government can have a profound impact on startup ecosystems. Research institutions and universities, for instance, can serve as incubators for new ideas and technologies. When these intellectual resources are combined with industry expertise and governmental support, a fertile ground is created for startups to thrive. By fostering a culture of innovation and entrepreneurship through strategic policy interventions, the potential for enhancing startup funding opportunities is substantially increased.

Collaborative Ecosystem for Funding

1. Public-Private Partnerships (PPP): These collaborations are crucial for enhancing startup funding opportunities by combining the strengths of the public sector and private investors to create a supportive funding environment.

2. Industry-Academia Collaboration: Such partnerships foster knowledge transfer and innovation, significantly enhancing startup funding opportunities by introducing academic expertise into the entrepreneurial space.

3. Incubator and Accelerator Support: Providing structured mentorship and resources, incubators and accelerators play a vital role in enhancing startup funding opportunities by preparing startups for investment readiness.

4. Investment Readiness Programs: These programs are designed to enhance startup funding opportunities by equipping entrepreneurs with the skills and knowledge necessary to attract and manage investment effectively.

5. Regional Investment Hubs: Establishing dedicated hubs can significantly enhance startup funding opportunities by centralizing resources and connecting startups with investors within a focused ecosystem.

Read Now : Custom Art Portfolio Consultations

6. Cross-Border Investment Networks: Creating networks for international investment is vital for enhancing startup funding opportunities, allowing startups to access a broader pool of potential investors.

7. Technology Transfer Offices: These offices facilitate the commercialization of research, thereby enhancing startup funding opportunities by translating innovations into viable business propositions.

8. Financial Education Initiatives: Educating entrepreneurs on financial management is essential for enhancing startup funding opportunities by ensuring that they can effectively manage and allocate received funds.

9. Mentorship Networks: Access to experienced mentors enhances startup funding opportunities by providing strategic guidance and connecting entrepreneurs with potential investors and partners.

10. Sustainable Investment Principles: Applying principles of sustainability to investment decisions can enhance startup funding opportunities, particularly in sectors focused on long-term environmental and social outcomes.

11. Diversity and Inclusion Programs: Initiatives promoting diversity can enhance startup funding opportunities by encouraging investment in underrepresented groups, thus broadening the entrepreneurial landscape.

12. Digital Platform Utilization: Utilizing digital platforms to match investors with startups significantly enhances startup funding opportunities by streamlining the investment process and increasing accessibility.

Long-Term Vision for Funding Success

The long-term success of enhancing startup funding opportunities hinges on the establishment of a resilient and responsive funding ecosystem. This ecosystem must be driven by a commitment to fostering innovation and sustainability in the entrepreneurial sector. As startups continue to shape the future, it is paramount that investors, policymakers, and other stakeholders adopt a holistic view of the funding landscape. Such a perspective recognizes the value of startups beyond mere economic metrics, considering their contributions to societal wellbeing and technological advancement. By investing in policies and practices that align with these principles, the potential for innovation is amplified, further enhancing startup funding opportunities.

Furthermore, cultivating an entrepreneurial culture that embraces risk and failure as integral components of the innovation process can significantly impact funding opportunities. When failure is seen as a learning opportunity, the fear of financial loss is diminished, encouraging more investments in startups with novel ideas and unconventional approaches. This paradigm shift toward a more accepting entrepreneurial climate can drive a surge in creative ventures that might have otherwise been overlooked. In effect, by fostering an environment that balances risk with opportunity, enhancing startup funding opportunities becomes a more attainable goal, ultimately paving the way for groundbreaking innovations and sustained economic prosperity.

Conclusions: The Path Forward

In conclusion, enhancing startup funding opportunities is paramount for fostering a dynamic and innovative economic landscape. The concerted efforts of various stakeholders, including financial institutions, governments, and the academic community, are necessary to create a robust funding ecosystem. By implementing strategic policy measures, creating collaborative networks, and providing tailored financial products, the potential for successful startup funding can be significantly increased. As global challenges continue to evolve, the role of startups in addressing these issues will become even more critical, necessitating ongoing support and investment.

Ultimately, the path forward in enhancing startup funding opportunities lies in fostering an environment that values innovation, embraces risk, and encourages diversity. By doing so, startups are better positioned to access the funding they need to bring transformative ideas to fruition. The cumulative effect of these efforts will be an enhanced ability to address contemporary challenges through entrepreneurial endeavors, driving economic growth and societal progress in the process.