In the competitive business landscape, maintaining a clear and concise budget is paramount for ensuring organizational sustainability and growth. The variety of business budget templates available today provides businesses with diverse options to suit their specific financial management needs. This article delves into comparing business budget template options to highlight their features and benefits. Constructed in a formal style, this discourse aims to guide businesses in selecting the most suitable template for their unique circumstances.

Read Now : How To Showcase Personal Strengths

Considerations in Comparing Business Budget Template Options

When comparing business budget template options, it is crucial to assess several factors. First, the complexity and size of the business must be considered, as larger businesses might require more intricate templates with advanced features, while smaller businesses may benefit from simpler, more straightforward designs. Second, the specific financial processes and reporting requirements of the company play a significant role in determining the appropriate template. Each organization must ensure that the template supports its distinctive financial activities and reporting standards effectively. Lastly, the accessibility and user-friendliness of the template are of utmost importance. A template that is easy to use can facilitate smoother financial management and enhance productivity by saving time and reducing errors. In summary, a careful examination of these criteria will aid businesses in selecting the most fitting budget template.

Key Features in Comparing Business Budget Template Options

1. Versatility: Business budget templates differ in their ability to accommodate various business models and financial structures. Comparing business budget template options necessitates evaluating their flexibility to adapt to changing business needs.

2. Integration: Many templates offer integration with accounting software. It is beneficial when comparing business budget template options to consider their compatibility with existing financial systems for seamless data transfer.

3. Customization: Customizable templates allow businesses to tailor financial reports to their specific needs. This feature is particularly important when comparing business budget template options to ensure they align with organizational requirements.

4. Scalability: As businesses evolve, so too should their budgeting tools. When comparing business budget template options, consider whether they can scale in complexity and functionality to accommodate growth.

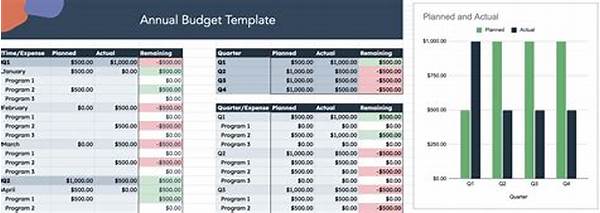

5. Visual Representation: Effective templates provide graphical representations of financial data. Comparing business budget template options includes examining their capacity to illustrate data in a manner that aids comprehension and decision-making.

Understanding the Importance of Comparing Business Budget Template Options

Selecting the right business budget template is imperative for effective financial management. Comparing business budget template options helps businesses identify the tools that align best with their operational needs. Proper budgeting facilitates accurate financial forecasting, which is essential for decision-making and strategic planning. Through the process of comparing business budget template options, businesses can discover templates that offer the necessary depth of detail for informed financial analysis. Moreover, tailored templates can enhance the financial literacy of personnel, empowering them to make educated decisions that drive the organization forward. As such, the exercise of comparing business budget template options is an investment in the organization’s financial health.

Criteria for Comparing Business Budget Template Options

1. Cost Analysis: Evaluate whether the template fits within the organization’s budget and the value it offers relative to its price.

2. Ease of Use: Consider the learning curve associated with the template to ensure it does not hinder productivity.

3. Reporting Capabilities: Examine the template’s ability to generate comprehensive reports that meet the organizational needs.

4. Data Security: Ensure that the template offers robust security features to protect sensitive financial information.

5. Support and Resources: Assess the availability of customer support and resources, such as tutorials and guides, to aid in template utilization.

Read Now : Building A Multicultural Learning Environment

6. Accuracy and Reliability: Scrutinize the template’s record in ensuring financial data accuracy and reliability.

7. User Feedback and Reviews: Consider feedback from other users to gauge the template’s performance and reliability.

8. Compatibility: Verify the template’s compatibility with other tools and software used by the organization.

9. Future-proofing: Ensure that the template is designed to evolve and incorporate future technological advancements.

10. Customization Flexibility: Evaluate the degree to which the template can be customized to fit specific needs.

11. Industry-specific Requirements: Check if the template meets the particular needs of industry-specific budgeting practices.

12. Cloud-based Solutions: Assess the benefits of using cloud-based templates for real-time access and collaboration capabilities.

Strategic Implications of Comparing Business Budget Template Options

In today’s fast-paced business environment, a well-chosen budget template can significantly impact a company’s strategic direction and operations. Comparing business budget template options empowers businesses to make informed choices that align with their long-term goals and objectives. An effective template not only simplifies budgeting processes but also enhances transparency and accountability in financial operations. By thoroughly comparing business budget template options, organizations can unlock opportunities for process optimization, accurate financial forecasting, and streamlined reporting. Additionally, integrating the right budget template into an organization’s workflow can drive strategic growth and contribute to increased competitiveness in the market. Consequently, the act of comparing business budget template options is not just a tactical decision but a strategic commitment to fostering long-term success.

Conclusion and Summary of Comparing Business Budget Template Options

In summary, comparing business budget template options is a vital process that enables organizations to align their financial practices with strategic objectives. The selection of an appropriate template is more than just a choice of tool; it embodies a commitment to rigorous financial oversight and planning. Key considerations include functionality, scalability, and compatibility, all of which play pivotal roles in determining a template’s suitability for an organization. The benefits of engaging in a meticulous comparison process are extensive, from enhanced efficiency and accuracy in budgeting practices to improved decision-making capabilities. As businesses continue to navigate the complexities of the modern financial landscape, the strategic importance of comparing business budget template options becomes even more pronounced. By adopting a diligent, comprehensive approach, organizations can ensure they are equipped with the optimal tools to enhance their financial planning and achieve enduring success.