In the contemporary business landscape, small business owners face a myriad of challenges, with effective financial management being paramount. Budgeting serves as a fundamental aspect of this financial stewardship, enabling businesses to allocate resources efficiently, anticipate future financial needs, and secure long-term viability. This article endeavors to elucidate key budgeting strategies for small business owners. By adopting systematic financial planning techniques, entrepreneurs can enhance profitability and ensure the sustainable growth of their businesses. The importance of a well-structured budgeting strategy cannot be overstated; it lays the groundwork for strategic decision-making and operational success.

Read Now : Scalable Cloud Infrastructure Management Tools

Understanding the Fundamentals of Budgeting

Budgeting strategies for small business owners begin with comprehending the foundational elements of a budget. This involves understanding income sources, predicting expenditures, and determining cash flow. At its core, budgeting is about creating a balance between income and expenses while ensuring adequate resources for unforeseen challenges and opportunities. For small business owners, this balance is crucial as it directly impacts their capacity to respond to market changes. A robust budget allows entrepreneurs to make informed decisions, reduce financial risks, and identify areas for potential cost savings. Moreover, developing a clear picture of financial health empowers business owners to set realistic growth objectives and ensure the longevity of their business endeavors. A well-crafted budget is not only a financial document but also a roadmap guiding every operational decision. By implementing effective budgeting strategies, small businesses can achieve operational excellence and sustainable growth, positioning themselves competitively in their respective industries.

Detailed Approaches to Budgeting

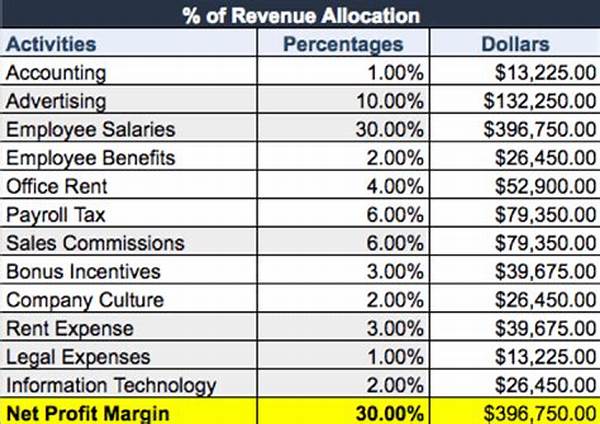

1. Cash Flow Management: One of the critical budgeting strategies for small business owners is prioritizing cash flow management. This involves detailed tracking of expenses and revenues to ensure liquidity is maintained, enabling businesses to meet obligations as they arise.

2. Expense Categorization: Small business owners should adopt meticulous expense categorization. By classifying costs into essential and non-essential, businesses can effectively allocate resources and identify areas where cost reductions could be feasible.

3. Forecasting and Flexibility: Budgeting strategies for small business owners should encompass forecasting economic variables while maintaining flexibility to adjust tactics as necessary. This dual approach ensures preparedness for both anticipated and unexpected financial developments.

4. Leveraging Technology: Employing sophisticated financial tools is a fundamental aspect of budgeting strategies for small business owners. Technology can facilitate accurate record-keeping and analysis, aiding in more precise budgeting decisions.

5. Regular Budget Review: Routine evaluation of the budget allows businesses to stay on course. Regularly revisiting financial plans helps in identifying deviations, thereby providing an opportunity for corrective actions to maintain financial stability.

Read Now : Wallet-friendly Online Knowledge Enhancement Initiatives

The Importance of Budgetary Controls

Effective budgeting strategies for small business owners necessitate the implementation of robust budgetary controls. These controls are designed to ensure that actual business activities align with planned financial outcomes. Key components of budgetary controls include variance analysis, where the differences between forecasted and actual financial performance are examined meticulously. By regularly conducting this analysis, business owners can quickly identify and address discrepancies. Another critical element is setting realistic budgetary limits and ensuring adherence to them. This discipline is crucial for preventing overspending and promoting efficient resource allocation. Furthermore, integrating budgetary controls with overall business strategy enhances their efficacy, ensuring organizational objectives are met. Such proactive financial governance not only safeguards the financial health of small businesses but also empowers them to navigate the uncertainties of the market environment effectively.

Crafting a Financial Roadmap

A significant aspect of budgeting strategies for small business owners is the crafting of a comprehensive financial roadmap. This roadmap should encompass short-term and long-term financial goals, clearly articulating the steps necessary to achieve them. It serves as a strategic guide, directing decision-making processes and operational priorities. By aligning financial objectives with business strategies, entrepreneurs can facilitate growth while ensuring fiscal prudence. Additionally, a financial roadmap highlights potential financial risks, allowing for preemptive risk mitigation. By diligently adhering to this roadmap, small business owners can steer their enterprises toward achieving sustained profitability and competitive advantage in the marketplace. In sum, constructing and following a detailed financial roadmap is indispensable for small businesses aiming to thrive.

Challenges in Budgeting for Small Businesses

Despite the advantages, budgeting strategies for small business owners are not without challenges. Many entrepreneurs face constraints such as limited financial resources, market volatility, and unpredictable expenses. Addressing these challenges requires creativity and strategic foresight. For instance, even with tight budgets, prioritizing investments in critical areas such as technology and human resources can yield significant returns. Additionally, adopting a dynamic budgeting approach, where continuous adjustments are made in response to real-time financial data, can enhance adaptability. Effective budgeting extends beyond financial considerations, necessitating a holistic approach to business management. By remaining vigilant and flexible, small business owners can surmount budgeting challenges and secure a stable economic foundation for their businesses.

Summary of Key Budgeting Strategies

In summary, budgeting strategies for small business owners encompass a range of practices aimed at promoting financial health and sustainability. Initially, understanding the fundamentals of budgeting, such as income and expense management, lays the groundwork for effective financial planning. Detailed approaches, including cash flow management, expense categorization, and leveraging technology, further enhance budgeting efficiency. The implementation of budgetary controls ensures alignment with financial objectives, while crafting a financial roadmap provides strategic direction. Despite inherent challenges, such as market unpredictability, small business owners can adopt dynamic budgeting strategies to ensure resilience and growth. Ultimately, businesses that invest time and resources into sophisticated budgeting processes are better equipped to achieve their financial goals, navigate economic uncertainties, and sustain competitive advantage in their respective markets.