In an era where financial prudence is paramount, the utility of budget templates emerges as a crucial tool for both individuals and organizations. Serving as a systematic approach to financial management, budget templates provide a structured framework that facilitates the tracking of income, expenses, and savings. Their adoption is not merely a matter of convenience but an essential step towards financial stability and efficiency. This article delves into the manifold benefits of using budget templates, highlighting their role in effective financial planning and management.

Read Now : Discounted Online Educational Subscriptions

Streamlined Financial Planning

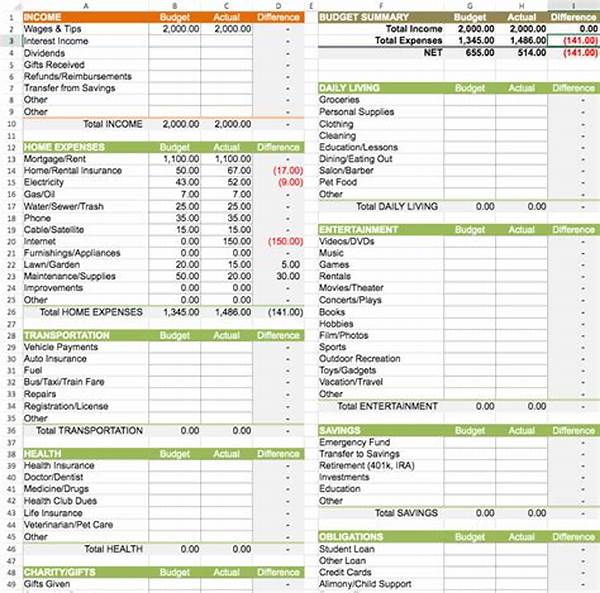

One of the preeminent benefits of using budget templates is their capacity to streamline financial planning processes. By offering a pre-defined layout, these templates save valuable time and effort otherwise spent on crafting a budget from scratch. Users are able to input their financial data into these ready-made structures, thereby focusing their attention on analyzing and optimizing their finances rather than creating the framework anew. Budget templates typically include categories for income, expenses, savings, and investments, which aids in a comprehensive overview of one’s financial state. Furthermore, they provide a visual representation of financial trends and patterns, empowering users to make informed decisions regarding their financial goals and priorities. Thus, the benefits of using budget templates extend beyond mere convenience, contributing significantly to a more organized and strategic financial management approach.

Enhanced Accuracy and Consistency

Another salient aspect of the benefits of using budget templates lies in the enhanced accuracy and consistency they provide. By employing a standardized format, budget templates minimize the likelihood of errors that may arise from manual calculations. This reduction in errors ensures that financial records are precise and trustworthy. Additionally, consistency in formatting aids in better comparison and tracking over time, allowing users to monitor progress and adjust their budgets effectively. The benefits of using budget templates thus encapsulate a refined approach to maintaining accurate financial records, fostering a more reliable financial analysis.

Budget templates also promote discipline in financial management. Regularly updating these templates assists in developing a habit of financial scrutiny and responsibility. The benefits of using budget templates, therefore, transcend the basic task of tracking finances; they play a pivotal role in cultivating diligent financial behavior.

Simplified Financial Oversight

The benefits of using budget templates include simplified financial oversight, allowing for easy tracking and analysis of spending patterns. By collating financial information in a structured manner, budget templates make it easier to identify areas of overspending or potential savings. This simplified oversight helps individuals and organizations to remain aligned with their fiscal objectives. Furthermore, budget templates can be customized to suit specific needs and preferences, providing a tailored approach to financial management. Thus, the benefits of using budget templates extend to personalized financial oversight, enhancing the ability to maintain control over one’s finances sustainably.

Tools for Personal and Professional Use

Facilitating Financial Growth

Budget templates play a fundamental role in facilitating financial growth, which is one of the understated benefits of using budget templates. They serve as a valuable tool for setting and achieving financial objectives, allowing users to allocate resources adequately while planning for future growth. By providing a clear picture of current financial conditions, budget templates aid users in devising effective strategies to increase savings and reduce unnecessary expenditures. This, in turn, fosters financial growth by encouraging an efficient allocation of resources and a focus on long-term financial goals.

Moreover, the benefits of using budget templates are also reflected in their contribution to informed decision-making. With all financial data consistently monitored and analyzed, users can make budgetary changes with confidence, thereby leveraging their financial capabilities effectively. These templates thus not only support the day-to-day management of finances but also underpin the strategic financial planning necessary for achieving sustainable economic advancement.

Read Now : Internet-based Education With Flexible Scheduling

The Role in Resource Allocation

The benefits of using budget templates extend notably into the realm of resource allocation. By providing a detailed view of income and expenditures, they act as a guiding framework for efficient resource distribution. Whether in a household or a corporate environment, the ability to allocate resources wisely fosters operational efficiency and can lead to significant cost savings. The structured insight gained from budget templates allows users to pinpoint areas requiring more funding or those where cutbacks can be achieved without hampering core objectives.

Moreover, budget templates play a critical role in avoiding resource wastage by highlighting redundant expenditures. They guide users in reallocating funds towards more productive avenues, such as investments or debt reduction, further enhancing the benefits of using budget templates. Steering conscious and optimal allocation of financial resources, these templates support a sustainable model of economics pertinent to varied financial landscapes.

Conclusion: Embracing Financial Efficiency

In summary, the benefits of using budget templates are extensive and multifaceted, encapsulating everything from enhanced financial planning and accuracy to fostering economic growth and resource allocation. By offering standardized frameworks, they provide clarity and insight into financial proceedings, enabling users to navigate the complexities of financial management with poise and confidence.

The embracement of budget templates signifies a commitment to efficiency and fiscal responsibility. As users integrate these tools into their financial routines, the consistent practice of monitoring, analyzing, and adjusting financial data becomes second nature, reinforcing prudent financial habits. Ultimately, the advantages of using budget templates are apparent not only in individual or organizational prosperity but in fortifying an economy rooted in strategic financial consciousness.