Understanding the Basics of Creating a Business Budget Template

Creating a business budget template is an essential practice for any organization seeking to manage its finances effectively. A well-structured budget template helps businesses plan and allocate resources, thus ensuring financial stability and growth. Initially, it involves identifying all sources of income and categorizing expenses accurately. This structured approach facilitates detailed financial forecasting, allowing businesses to predict cash flow and identify potential financial challenges. Furthermore, it ensures that resources are aligned with strategic goals, optimizing investments and expenditure.

Read Now : Student Achievement Tracking Methods

Additionally, creating a business budget template requires periodic reviews and adjustments. Businesses operate in dynamic environments where economic conditions and market trends fluctuate. By adopting a flexible budgeting approach, organizations can make informed decisions promptly, thereby enhancing their ability to adapt to sudden changes. Regular reviews of financial performance against the budget allow companies to understand variances, mitigate risks, and capitalize on new opportunities. Hence, the continuous evaluation and refinement of a business budget template are crucial for sustaining long-term financial health.

In summary, creating a business budget template constitutes a proactive approach to financial management. It fosters accountability by establishing performance metrics and enabling transparent tracking of financial activities. Moreover, a meticulously crafted budget template serves as a valuable communication tool, articulating financial expectations to stakeholders. The strategic implementation of a business budget template empowers organizations to achieve fiscal discipline, ultimately contributing to the overall success and operational efficiency.

Steps Involved in Creating a Business Budget Template

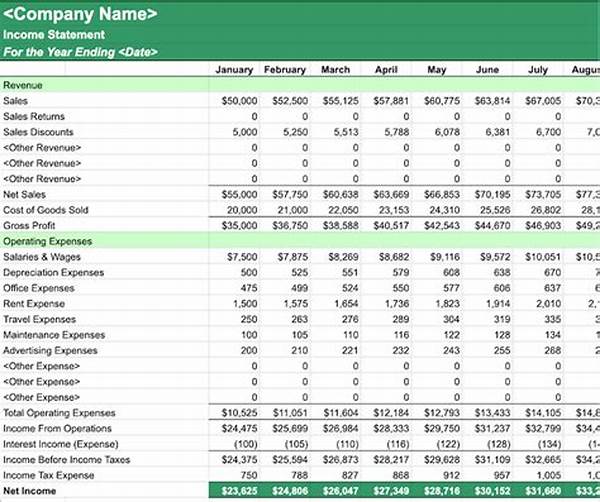

1. Initial Assessment and Analysis: Begin by performing a comprehensive assessment of the current financial situation. This involves analyzing historical financial data, identifying revenue streams, and listing all expenses. By understanding past financial performance, businesses gain insights for creating a business budget template that is realistic and achievable.

2. Defining Financial Goals: Set clear and measurable financial goals based on the organization’s strategic objectives. Establishing these goals provides a framework for creating a business budget template that aligns with long-term aspirations. Ensure that these goals are attainable and reflect the business’s growth ambitions.

3. Detailed Categorization of Revenue and Expenditures: Segment revenue and expenditure streams into detailed categories. This step simplifies the tracking of financial performance and enables more accurate forecasting. A well-categorized template aids in creating a business budget template that provides clarity and precision in financial reporting.

4. Incorporating Contingency Plans: Consider potential risks and uncertainties while creating a business budget template. Allocating provisions for unforeseen circumstances ensures financial resilience. A robust budget includes contingency plans that allow businesses to respond effectively to unexpected challenges.

5. Implementing Regular Review and Adjustment Procedures: Establish a schedule for regular reviews of the budget against actual performance. This facilitates timely adjustments, ensuring that the business remains on track to meet its financial goals. The adaptability incorporated in creating a business budget template enhances its effectiveness and relevance.

The Importance of Consistency in Creating a Business Budget Template

In creating a business budget template, consistency is of utmost importance to maintain cohesive financial management. By establishing standardized processes and methodologies, businesses ensure that the budget template is reliable and accurate. A consistent approach in categorizing expenses and revenues helps in maintaining uniformity, thereby simplifying the comparison of financial data across different periods. This uniform treatment of financial information is indispensable for deriving meaningful insights and ensuring the integrity of the financial analysis.

Furthermore, businesses must instill a culture of adherence to the established budget framework within all departments. When all stakeholders are aligned with the budgetary guidelines, compliance is strengthened, leading to enhanced financial discipline. Besides, the practice of consistency in creating a business budget template contributes significantly to building trust with investors and external stakeholders, as it conveys a sense of reliability and transparency in financial affairs.

Key Components in Creating a Business Budget Template

1. Revenue Projections: Accurately forecast future revenue to guide financial planning in creating a business budget template.

2. Expense Tracking: Categorize and monitor all expenditures meticulously to prevent overspending.

3. Cash Flow Management: Maintain a focus on cash flow to ensure liquidity for operational needs.

4. Variable and Fixed Costs Differentiation: Clearly distinguish between variable and fixed costs to aid in decision-making.

5. Break-even Analysis: Integrate break-even calculations to understand the minimum requirements for profitability.

Read Now : Digital Marketing Strategies For Entrepreneurs

6. Capital Expenditures Planning: Identify and plan for significant investments in assets.

7. Debt Management: Include considerations for debt servicing and interest obligations.

8. Profit Margins: Monitor profit margins to ensure they meet industry standards and internal targets.

9. Variance Analysis: Conduct regular variance analysis to identify deviations from the budget.

10. Scenario Planning: Develop alternative scenarios to prepare for various financial outcomes.

11. Strategic Alignment: Ensure the budget aligns with the strategic direction and goals of the business.

12. Reporting and Communication: Establish effective channels for disseminating budget information to key stakeholders.

Benefits of a Structured Approach in Creating a Business Budget Template

Implementing a structured approach in creating a business budget template yields numerous benefits. Firstly, it brings clarity and direction to financial planning, enabling organizations to allocate resources effectively. By having a clear understanding of income and expenditures, businesses can prioritize investments and manage costs efficiently. This structured framework supports optimal decision-making, aligning financial strategies with broader organizational goals.

Furthermore, structured budgeting enhances accountability within the organization. By assigning responsibilities and setting performance benchmarks, it empowers departments to meet targets and adhere to budgetary constraints. Transparency in financial reporting, a result of structured budgeting, provides stakeholders with a comprehensive view of the organization’s financial health, thereby fostering trust and credibility.

Lastly, creating a business budget template with a structured approach facilitates risk management. By anticipating potential financial challenges and preparing contingency plans, businesses can mitigate uncertainties and ensure resilience. This proactive approach not only safeguards financial stability but also enables businesses to seize opportunities that align with their strategic vision.

Conclusion: Creating a Business Budget Template

In conclusion, creating a business budget template is a sophisticated yet indispensable task for achieving financial success. By embracing a meticulous and consistent approach, businesses can ensure efficient financial management and strategic growth. A well-crafted budget template serves as a cornerstone for informed decision-making, enabling organizations to navigate the complexities of the business environment confidently. Furthermore, continuous evaluation and adaptation of the budget template position businesses to address financial challenges proactively, ensuring sustainability and resilience in the dynamic economic landscape.