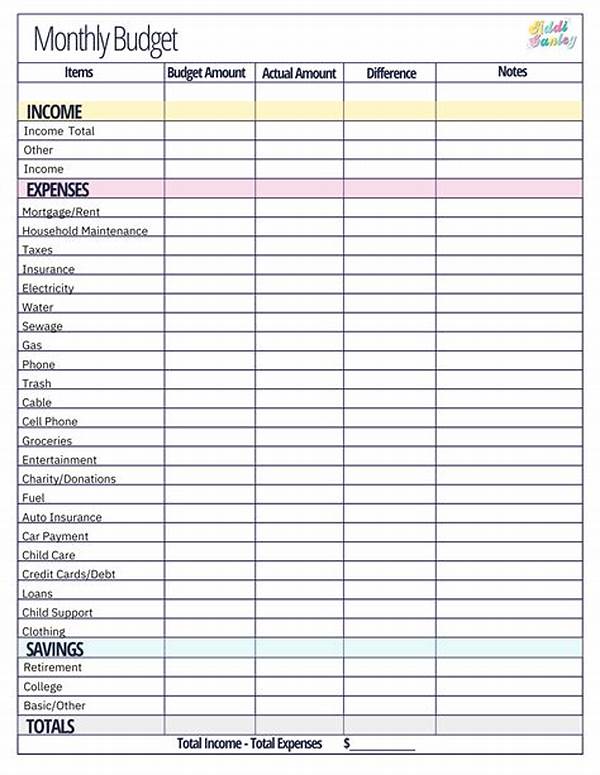

In the ever-evolving landscape of business finance, the demand for efficient budgeting solutions has become increasingly paramount. One such tool that has proven indispensable is the customizable template for budgeting businesses. These templates offer a structured yet flexible framework that caters to the diverse financial planning needs of various enterprises. Their adaptability allows businesses to tailor their budgeting procedures according to specific objectives and financial landscapes. In an age where precision and adaptability are critical, these templates have emerged as essential resources for financial management and strategic planning.

Read Now : Top-rated Online Course Providers

The Importance of Customizable Templates for Budgeting Businesses

Customizable templates for budgeting businesses serve as foundational instruments in achieving effective financial oversight. With the complexities inherent in financial planning, these templates provide a comprehensive structure that simplifies the process while allowing for bespoke tailoring. Businesses can harness these templates to align their financial strategies with organizational goals, ensuring a cohesive approach to fiscal management. Furthermore, their adaptability ensures that the templates can be modified in response to dynamic market conditions, thus offering a robust solution that accommodates growth and change. This flexibility not only enhances accuracy in financial projections but also empowers businesses to make informed decisions based on reliable data. Customizable templates for budgeting businesses, therefore, represent an intersection of precision and adaptability—the cornerstones of modern financial planning.

Key Features of Customizable Templates for Budgeting Businesses

1. User-Friendly Interface: Customizable templates for budgeting businesses boast an intuitive design that simplifies data entry and analysis.

2. Scalable Structure: These templates can accommodate businesses of varying sizes, from startups to established corporations.

3. Real-Time Data Integration: By integrating real-time financial data, these templates ensure that budgeting decisions are based on the latest available information.

4. Adaptability: The templates allow for modifications according to specific business needs, ensuring relevancy in diverse contexts.

5. Enhanced Reporting Features: With customizable templates for budgeting businesses, generating comprehensive reports becomes seamless, promoting transparency and informed decision-making.

Benefits of Using Customizable Templates for Budgeting Businesses

The utilization of customizable templates for budgeting businesses transcends mere convenience, providing significant advantages in financial management. Firstly, these templates facilitate a structured approach to budgeting, thereby enhancing organizational efficiency and resource allocation. They also contribute to risk mitigation by enabling proactive financial planning and adjustments in response to unforeseen circumstances. Secondly, these templates promote consistency across various departments, ensuring that all sectors of a business align with the overarching financial strategy. Lastly, the inherent adaptability of such templates ensures that they remain pertinent regardless of changes in the economic landscape or organizational growth trajectories. Thus, businesses that leverage customizable templates for budgeting can enhance their competitiveness and sustain financial health in volatile markets.

Examples of Customizable Templates in Business Budgeting

Here, we enumerate several examples of customizable templates for budgeting businesses:

1. Startup Budget Template: Tailored for emerging businesses, focusing on initial capital expenditure and cash flow projections.

Read Now : Stem-focused Courses For Children

2. Departmental Budget Template: Allows for detailed tracking of departmental expenses and resource allocation.

3. Cash Flow Forecast Template: Provides a forward-looking view of anticipated inflows and outflows, critical for liquidity management.

4. Project Budget Template: Helps manage specific projects, focusing on cost control and resource distribution.

5. Annual Budget Template: Offers a macro-perspective on a business’s yearly financial performance and strategy.

Integration of Technology in Customizable Templates for Budgeting Businesses

The integration of advanced technology in customizable templates for budgeting businesses has revolutionized financial planning practices. Features such as automated data entry, cloud storage, and real-time updates enable businesses to maintain precision in their financial records while promoting efficiency. Technologies such as artificial intelligence and machine learning are now being embedded within these templates to offer predictive analytics and insights, thus empowering businesses to anticipate market trends and adapt their strategies accordingly. This technological symbiosis significantly enhances a business’s capability to manage finances with agility and accuracy, ensuring that the budgeting process remains robust and relevant in an increasingly complex fiscal environment.

Conclusion

In summation, customizable templates for budgeting businesses offer a dynamic and essential toolkit for comprehensive financial planning. With their flexibility and adaptability, these templates stand as crucial assets for any business striving to maintain fiscal discipline and strategic alignment in today’s fast-paced financial landscape. Implementing such templates can lead to substantial improvements in accuracy, resource management, and strategic foresight, thereby bolstering a business’s ability to navigate economic challenges and seize opportunities. In an era where informed financial decision-making is paramount, customizable templates for budgeting businesses offer the precision and versatility that contemporary enterprises require.