In today’s rapidly evolving financial environment, budget management has become increasingly critical. Budget templates serve as valuable tools that facilitate efficient financial planning and management. These templates are designed to aid individuals and organizations in adhering to their financial goals by providing structured and systematic financial plans. The significance of properly curated budget templates lies in their ability to provide a comprehensive snapshot of the financial landscape, aiding in various areas such as expense tracking, resource allocation, and financial forecasting.

Read Now : Choosing The Right Business Budget Templates

Understanding the Structure of Budget Templates

The key features of budget templates are designed to cater to the diverse needs of users, ranging from personal finance to complex corporate budgeting. Primarily, these templates are structured to offer a clear and concise overview of both inflow and outflow of funds. Typically, a well-structured template will include sections for income sources, fixed and variable expenses, savings, and investments. Furthermore, the categorization of expenses allows for an easy comparison between projected and actual spending. This structured approach ensures that individuals and organizations alike can monitor their financial activities effectively. Additionally, budget templates often incorporate visual aids like graphs and charts, which enhance the user’s ability to analyze financial data proficiently. These graphical representations facilitate a quicker understanding of financial trends and deviations from planned financial paths, thereby enabling timely corrective actions.

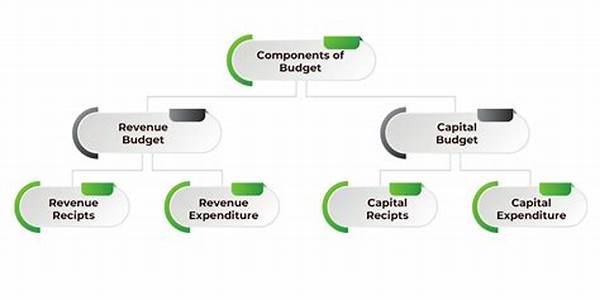

Key Components in Budget Templates

1. Income and Expense Tracking: The key features of budget templates often include precise sections dedicated to tracking income and expenses, allowing for meticulous oversight of financial activities.

2. Customization Options: Effective templates offer customization options, enabling users to tailor the document according to their specific financial scenarios, which prove essential for personalized financial management.

3. Projection Capabilities: A significant feature is the ability to project future financial outcomes, aiding users in planning for upcoming financial commitments with greater precision.

4. Resource Allocation Guidance: Templates provide guidance on resource allocation, ensuring that funds are appropriately assigned to various obligations, enhancing financial efficiency.

5. Goal Setting and Monitoring: An essential component, the goal-setting feature allows users to define financial objectives and monitor progress, ensuring alignment with broader financial strategies.

Read Now : Interdisciplinary Cooperation Strategies

The Practical Benefits of Budget Templates

The key features of budget templates are instrumental in promoting financial discipline and strategic planning. Users who employ these templates benefit from an organized financial framework that supports both short-term and long-term financial goals. By utilizing the income and expense tracking features, individuals and businesses can gain insight into their spending behaviors, thereby promoting informed decision-making. Moreover, the customizable nature of these templates allows for flexibility in addressing specific needs, making them adaptable to changing financial situations. This adaptability is critical in the face of unforeseen financial challenges.

Enhancing Financial Management with Budget Templates

Budget templates serve as indispensable tools in the realm of financial management. Their key features allow for a systematic approach to financial tracking and analysis, promoting transparency and accountability in financial dealings. By incorporating visual data representations, users are better equipped to understand their financial positions and make data-driven decisions. These templates also facilitate effective communication of financial plans and performances within organizations, enhancing collaborative financial planning. Furthermore, the longitudinal use of these templates enables historical financial data analysis, fostering a deeper understanding of financial trends and informing future financial strategies.

Optimizing Financial Effectiveness through Budget Templates

The key features of budget templates provide vast opportunities to enhance financial effectiveness significantly. By employing a structured approach, these templates aid in demystifying complex financial data, making it accessible and actionable for the user. This structured data management is essential for resource optimization within organizations, ensuring that budgetary allocations align with strategic goals. Additionally, the predictive capabilities offered by these templates assist in anticipating financial hurdles and opportunities alike, offering a strategic advantage in dynamically allocating resources. Such foresight is invaluable for maintaining financial resilience and supporting sustainable growth.

Conclusion: Summarizing Key Features of Budget Templates

In summary, the key features of budget templates present a structured and efficient approach to financial management. By encompassing areas such as income tracking, expense monitoring, resource allocation, and future financial projections, these templates provide a comprehensive framework for financial planning. The customizability and visualization tools embedded within these templates further enhance their usability, catering to both personal and professional financial settings. The utilization of these templates not only aids in achieving financial objectives but also fosters a culture of fiscal responsibility and informed decision-making. Through these key features, budget templates prove to be indispensable in navigating the complexities of financial planning and management in contemporary settings.